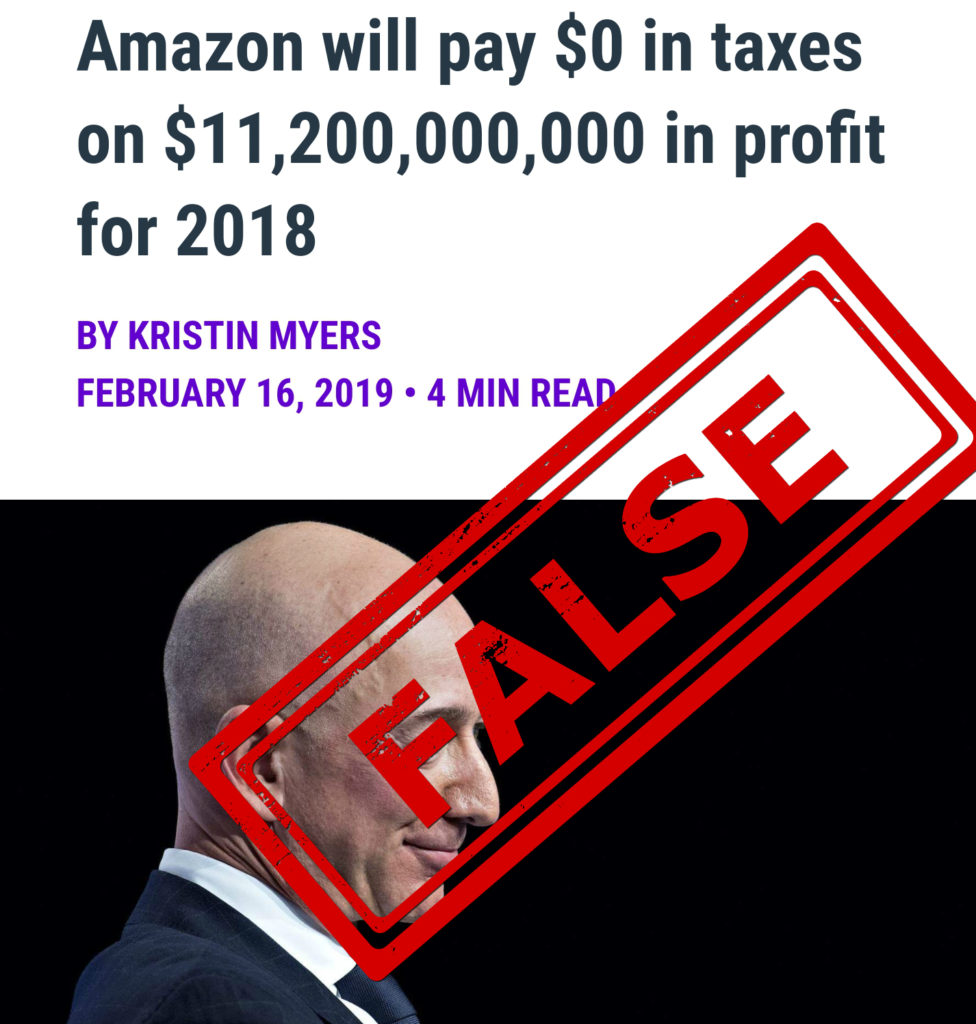

According to an already highly deceptive report by Institute on Taxation and Economic Policy, Amazon will pay no federal income tax on its 11.2 billion dollar profit in 2018. What they mean by federal income tax in this report is of course the corporate tax. I don’t know why they didn’t just come out and say the real name of the tax they are referring to, but that is besides the point. The main stream media, AOC, and Bernie Sanders, have taken this report, and have converted it to full blown fake news. Lets explore the various claims, and their degrees of wrongness.

Amazon will pay no taxes on 11.2 billion of profits in 2018. This is a straight up bold face lie. A quick look at Amazon’s financial statements shows that it does pay taxes. Cash paid for taxes in 2018 was 1.18 billion dollars. This number accounts for local, state and international taxes. Amazon also paid plenty of payroll taxes, which is a federal level tax.

Amazon will pay no federal taxes: This is a more specific claim, yet still wrong. There is no loopholes for payroll taxes. Amazon has paid payroll taxes for every single employee they have in 2018. Since payroll taxes are a federal tax, this statement is also wrong.

Amazon will pay no federal income taxes: The federal income tax is known as the corporate tax. Amazon will indeed pay no corporate tax on their 11.2 billion dollar profit in 2018. Though this statement is technically true, the implication of this statement is that Amazon is somehow shielding this profit from being taxed at all by using tax loopholes. This implication is false. One of the reasons that Amazon will pay no corporate tax on the profit is because it opted to pass it on to its employees as stock compensation. Any profits passed on to employees are not taxed at the corporate level, and are simply taxed at the individual federal income tax level. This is done to avoid double taxation on employee compensation. So even though the profit was not taxed at the corporate level, it would be incorrect to say that it was not taxed at all. The other reason that Amazon did not pay any corporate taxes is simply because they chose to spend it on operations. Amazon spent 22.6 billion dollars on research and development in 1 year, and an additional 60 billion on plant and equipment expansion over the last 5 years. These expenditures amount to significant tax write offs.

It is easy to vilify Amazon and claim they are using tax loopholes. The truth is however, that Amazon has reinvested the profits in either operations or its employees, both of which are perfectly valid choices available to any company operating in the US.