Lol, so my first thought was,

My second thought was.

I am sorry, but socialism cannot win, it can only destroy. People who participate in destructive behavior often have a desperate need to believe that they’re good. That is the only explanation I have for the over the top congratulatory spasms the left is experiencing right now. As I will explain, their claim for Krugman’s victory is analogous to a boxing match, in which Krugman has been taking a beating in each round only to accidentally dodge one punch, and claim victory.

Now consider the reality of the situation and tell me its any different.

“An academic paper that found that a ratio of 90%-debt-to-GDP was a threshold above which countries experienced slow or no economic growth was found to contain an arithmetic calculation error. Once the error was corrected, higher government debt levels still correlated with slower economic growth, but the relationship was not nearly as pronounced.”

Apparently this is the victory. That Krugman’s economic policies are not nearly as horrible for growth as previously thought. Yay?

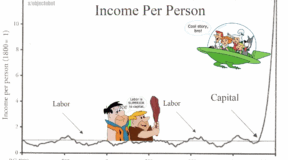

So why the spin? Its not spin, they actually believe it. When people are doing evil things, they desperately need to believe they’re good. I mean when you are putting future generations that don’t even have a say in the matter into debt, so that you can have a higher standard of living now. If your actions don’t actually do any good, what kind of person would you be?

The rest of the article continues to make the typical absurd claims of an economic illiterate. For instance.

“Smaller economies produced less tax revenue, the countries’ deficits also remained strikingly high. “

The implication being that if government doesn’t spend more the economy will be smaller. I believe that is the actual issue of the debate. You can’t just take the subject of our debate and an assume you are right. Besides according to Krugman himself, majority of the borrowed funds comes from our selves. So taking money from our selves, then giving it back to our selves, and taxing it while it goes through, is going to increase the economy and the tax revenue? No its not.

They continue.

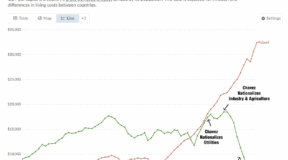

“Japan, for example, has continued to increase its debt-to-GDP ratio well beyond the supposed collapse threshold, and its interest rates have remained stubbornly low. “

Japan is the exception. I am suppose to just pretend that interest rates didn’t just explode in Europe?

“Countries that embraced (or were forced to adopt) austerity, like the U.K. and Greece, have endured multiple recessions (and, in the case of Greece, a depression).”

UK didn’t actually cut anything, and Greece, um hello! It is in a depression precisely because it reached a debt threshold where the bond investors suddenly freaked out and demanded higher interest rates, and as result Greece collapsed under the weight of staggering debts.

This is really the central issue of any country that has deficit spending. At some point debt reaches a level that cannot be repaid. At this point previous debt is paid for by new doses of government debt. The only reason that new debt is able to be issued is because investors are confident that their investments will be rolled over. That means that an investor expects that there will be investors in the future who will be willingly lend money to the government. Applying the same reasoning, the future investors must also expect that, when their government investments become due, there will be other investors even further out in the future who will willingly lend money to the government. So if today’s investors lose confidence that there will be investors in the future to roll over maturing government debt because they (rightly or wrongly) fear there is no longer an incentive to keep servicing government debt, the trouble starts, government debt financing declines rapidly or completely evaporates. This is the issue for almost every single country on earth, which are all on an unsustainable path. Krugman and the media can ignore the reality as long as they want. What they won’t be able to ignore is the consequences. The current trend cannot go on forever, and what cannot go on forever won’t.